Introduction

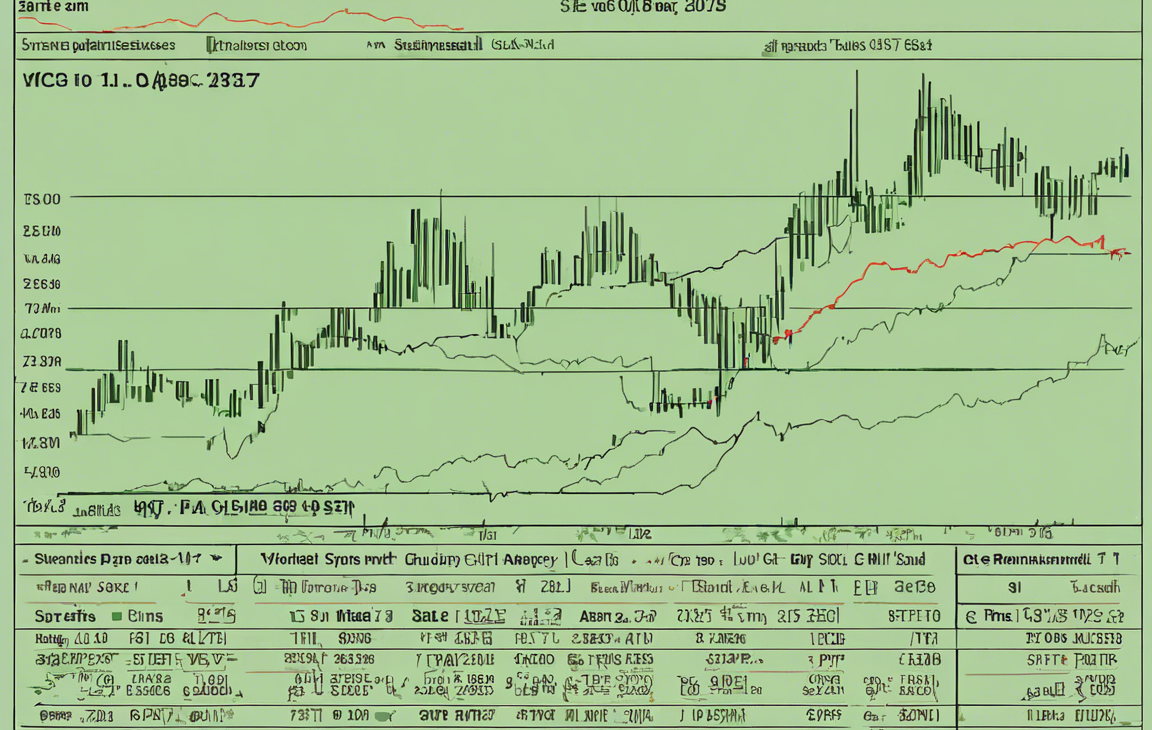

As an investor, it is crucial to stay informed about the trends in share prices of different companies. One such company that has been gaining attention in recent times is Greenpanel Industries Limited. By analyzing the share price trends of Greenpanel, investors can make informed decisions regarding their investment strategies. In this article, we will delve into the factors affecting Greenpanel share prices, historical trends, and how investors can interpret this data to make informed decisions.

Factors Affecting Greenpanel Share Prices

-

Market Trends: The overall market trends play a significant role in influencing the share prices of companies like Greenpanel. Factors such as economic growth, interest rates, and industry performance can impact the share prices.

-

Company Performance: Greenpanel’s own financial performance, revenue growth, profitability, and market position can directly influence its share prices. Investors often look at metrics like earnings per share (EPS), return on equity (ROE), and debt levels to assess the company’s health.

-

Industry News: Developments in the wood panel industry, changes in regulations, or new technologies can affect Greenpanel share prices. Keeping track of industry news and trends is essential for investors.

-

Macroeconomic Indicators: Factors like inflation, GDP growth, and currency fluctuations can have a ripple effect on share prices. Investors should monitor these indicators to gauge the overall economic health.

Historical Trends in Greenpanel Share Prices

Analyzing historical trends can provide valuable insights into how Greenpanel share prices have performed over time. By looking at past data, investors can identify patterns and make more informed decisions. Here are some key points to consider:

-

Upward Trends: Look for periods where Greenpanel share prices have consistently increased. This could indicate a strong company performance and positive investor sentiment.

-

Downward Trends: Similarly, identify periods of declining share prices. This could be due to poor financial results, industry headwinds, or external factors impacting the company.

-

Volatility: Pay attention to periods of high volatility in Greenpanel share prices. Sudden fluctuations can be indicative of market uncertainty or company-specific news.

Interpreting Share Price Data

When interpreting share price data, investors should consider the following:

-

Technical Analysis: Use technical indicators like moving averages, relative strength index (RSI), and Bollinger Bands to analyze share price trends and identify potential entry or exit points.

-

Fundamental Analysis: Evaluate Greenpanel’s financial statements, industry comparisons, and future growth prospects to determine the intrinsic value of the company’s shares.

-

Sentiment Analysis: Monitor investor sentiment through news, social media, and analyst reports to gauge market expectations and sentiment towards Greenpanel.

-

Diversification: Spread investment across different asset classes and sectors to reduce risk and optimize returns. Avoid putting all your funds into a single stock like Greenpanel.

FAQs

- What is the current share price of Greenpanel Industries Limited?

-

The current share price of Greenpanel Industries Limited is Rs. XXXX (as of [date]).

-

Has Greenpanel paid dividends in the past?

-

Yes, Greenpanel has a history of paying dividends to its shareholders.

-

Is Greenpanel a growth stock or a value stock?

-

Greenpanel can be classified as a growth stock due to its focus on expanding its market presence and product offerings.

-

How can I stay updated on Greenpanel share price trends?

-

You can monitor Greenpanel share prices on financial news websites, stock market apps, and the company’s investor relations page.

-

What are some key competitors of Greenpanel Industries Limited?

- Some key competitors of Greenpanel include [Competitor 1], [Competitor 2], and [Competitor 3].

In conclusion, analyzing Greenpanel share price trends requires a combination of technical, fundamental, and sentiment analysis. By understanding the factors influencing share prices, historical trends, and interpreting data accurately, investors can make informed decisions about their investments in Greenpanel Industries Limited. It is essential to stay informed, diversify your portfolio, and seek professional advice when needed to optimize investment outcomes.